Introduction to Financial Wellness

Understanding fiscal wellness involves delving into the nuanced interplay between one's monetary habits and their broader life satisfaction. It goes beyond mere budgeting and enters the realm of holistic well-being, where financial choices are interwoven with psychological, emotional, and physical health. At its core, fiscal wellness embodies the ability to manage one's economic life effectively—ensuring expenses are in harmony with income, building savings, and judiciously steering through credit.

Responsible banking plays a crucial role in fostering this financial equilibrium. By choosing financial institutions that prioritize transparency, provide sound advice, and offer tools for making informed decisions, individuals equip themselves with the means to create a sustainable economic landscape. This mutual relationship with a bank or credit union can provide one with a sense of security and control, mitigating stress and enhancing overall well-being.

Furthermore, fiscal wellness isn't a one-size-fits-all concept; it requires tailoring strategies to individual circumstances and life stages. Whether it's seeking financial guidance in times of need or leveraging investment opportunities for future gain, adopting a proactive and informed approach crystallizes the essence of true financial health. By cultivating a mindful relationship with money, individuals can not only alleviate anxiety but also lay the foundation for a fulfilling life, marked by economic stability and personal contentment. To aid in this journey, one might want to learn more about personal finance tips.

Abound Credit Union's Community Initiatives

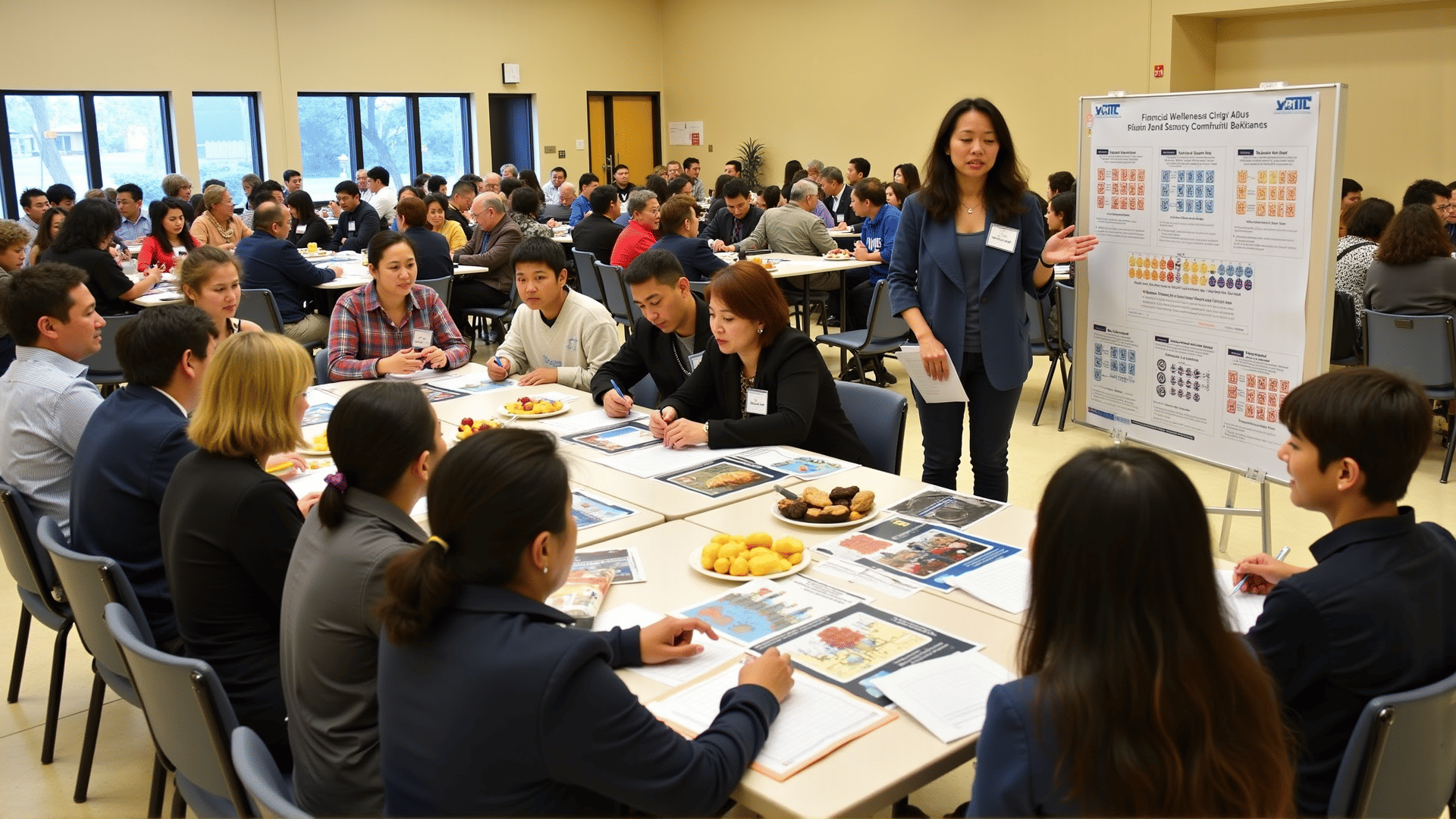

Abound Credit Union distinguishes itself through its genuine dedication to enhancing financial literacy and empowerment within the community. Through an extensive range of programs, the credit union not only highlights the significance of financial education but also effectively equips individuals with the insights and resources required to manage the intricate financial landscape. Among its numerous initiatives, Abound Credit Union hosts workshops and seminars customized for varied age groups and life stages, ensuring financial literacy is within reach for everyone. These educational programs encompass a broad array, from fundamental budgeting techniques to advanced investment planning, enabling participants to learn more about personal finance tips.

Furthermore, Abound Credit Union extends past traditional financial education, with a focus on empowerment via community involvement. By forging collaborative partnerships with local schools and nonprofit organizations, the credit union provides tailored support to underserved communities, underscoring the notion that financial stewardship is a crucial element of both individual and community prosperity. Additionally, the credit union’s commitment is further embodied through efforts that provide practical financial aid, details of which can be explored further on their financial assistance page. This comprehensive approach illustrates Abound Credit Union's resolve to not only educate the community but also actively contribute to their empowerment and enduring financial health.

Financial Education Programs Offered

Within the intricate network of today's economic landscape, financial education initiatives emerge as critical instruments in fostering fiscal intelligence and equipping individuals with the tools needed to navigate the complexities of modern finance. These endeavors act as channels for improving financial wisdom, thereby arming people with the understanding to make informed and discerning financial choices.

These programs often cover an extensive range of topics, from essential personal finance tactics to sophisticated investment theories. Participants are usually exposed to the fundamental principles of financial planning, thrift, credit control, and debt alleviation, nurturing a more profound insight into the financial ecosystem. Additionally, higher-level courses frequently explore areas such as asset distribution, risk management, and the intricacies of financial instruments, thereby extending the reach of financial education beyond the basics.

The overarching mission of these initiatives transcends mere information dissemination and aims to foster a shift in mindset towards active and judicious financial management. By imparting essential knowledge and promoting analytical thinking, these programs aspire to instill a sense of financial empowerment, enabling individuals to overcome basic economic hurdles and make perceptive decisions that harmonize with their individual and long-term monetary objectives.

Moreover, the expansion of such educational opportunities is vital in addressing imbalances in financial literacy often associated with varying socio-economic statuses. By democratizing financial insight, these initiatives aim to reduce systemic inequalities and cultivate a more informed citizenry.

In summary, the importance of financial education programs is immense, as they establish the foundation for a more knowledgeable and economically resilient community. For further exploration of prudent financial approaches, consider explore our financial assistance programs or learn more about personal finance tips to enhance your economic acumen.

Interactive Workshops and Resources

In a period where financial agility determines future prospects, participating in hands-on seminars emerges as a crucial chance to strengthen one's monetary insight. These thoughtfully designed gatherings are conceived not as inactive talks but as lively conversations where attendees can dive into practical situations, boosting their economic wisdom. Whether you're steering through the complicated maze of savings, asset growth, or debt oversight, these meetings are a fountain of understanding that empowers individuals to make prudent choices.

Participants may access a variety of materials tailored to clarify the enigmatic world of finance. These aids are crafted with care, aligning with various learning styles, whether through engaging online seminars, detailed manuals, or actionable toolkits. The seminars and materials act as a bridge to enhance not only individual financial prosperity but also to improve the community's shared knowledge and safety.

For those aiming to explore further into personal economics, the domain of online knowledge beckons, with expertly picked advice and techniques to build a solid financial foundation. Engaging with these materials promises not only an improvement in fiscal health but also a transformative path towards becoming masters of one's financial future. Understanding where to dedicate your attention and resources can be crucial, and these seminars offer the perfect setting to refine the expertise needed to achieve financial strength. You may want to explore our financial assistance programs or learn more about personal finance tips to fortify your understanding.

The Impact of Financial Empowerment

Financial empowerment goes far beyond mere economic gain, deeply weaving itself into the very fabric of sustainable community development. It acts as a catalyst for a chain reaction, sparking a multitude of socio-economic changes that reach beyond initial financial backing. By providing individuals with the essential tools, insights, and resources to manage and grow their financial holdings prudently, we are not merely improving their personal lives but also strengthening the communal safety net that supports society as a whole.

Enhanced financial skills foster independence, instilling a sense of agency and assurance. This change is especially impactful among marginalized groups, as it directly challenges and reduces cycles of poverty. With financial understanding and resources within reach, individuals are able to make informed choices, pursue entrepreneurial endeavors, and ultimately contribute to regional economies. This expansion of entrepreneurial activities within a neighborhood leads to job creation, stimulates local commerce, and inspires further investment in public infrastructure, thereby ensuring economic durability.

Furthermore, as communities become more financially capable, they naturally develop a vested responsibility in sustainable actions. Empowered individuals and communities are more inclined to participate in pursuits that prioritize environmental care and ethical commerce, recognizing that the long-term vitality of the economy is inseparable from the well-being of the planet. Financial empowerment amplifies a spirit of sustainability, encouraging community members to support local businesses and initiatives that align with these principles, paving the path for enduring prosperity.

In essence, financial empowerment is not just an economic drive but a critical pillar in building a more just and sustainable society. It lays a foundation of stability and possibilities from which future generations can flourish, fostering a culture that values not only economic achievement but also social responsibility and unity. For further insights into accessing monetary resources and schemes, please explore our financial assistance programs and learn more about personal finance tips.